Aged Care Planning Insights

With Richard Newton, Aged & Disability Care Specialist Adviser

When it comes to planning for retirement, few of us think beyond the opportunity to travel and do all those things we have been putting off until we have more time and fewer responsibilities. Moving into residential aged care may not be on your bucket list, but as the population ages, it’s a possibility that few of us can ignore.

According to the Australian Institute of Health and Welfare, more than 3.6 million Australians, or 16% of the population, are currently aged 65 and over. This is projected to grow to 22% by 2061, or more than one in five. We’re also living longer. The average Australian can expect to live into their 80’s, and many of us will live beyond 90. That means more of us will need some form of aged care late in life. And as pressure grows on aged care service providers to cater for more people, the costs may rise.

What will you pay?

In recent years the government has tightened the rules around the calculation of means-tested fees for residential aged care. The aim is to make the provision of aged care services sustainable as the demand for high quality accommodation grows. As we begin to consider the future care of not only ourselves but our older loved ones, it is important to understand what we can realistically expect to pay.

Watch out for “extras”

Although the government caps the annual and lifetime means-tested fees, you may be asked to pay extra for things such as a higher standard of accommodation, hairdressing, wine with meals, internet access and excursions. It’s important to check with the facility first to find out what is offered and how much these extra services will cost. In some cases, the charges exceed the services supplied and can add up to a substantial amount.

Aged care providers must give itemised accounts to the resident breaking down each of these services and the associated charge. Legislation also states that these fees cannot be charged more than one month in advance.

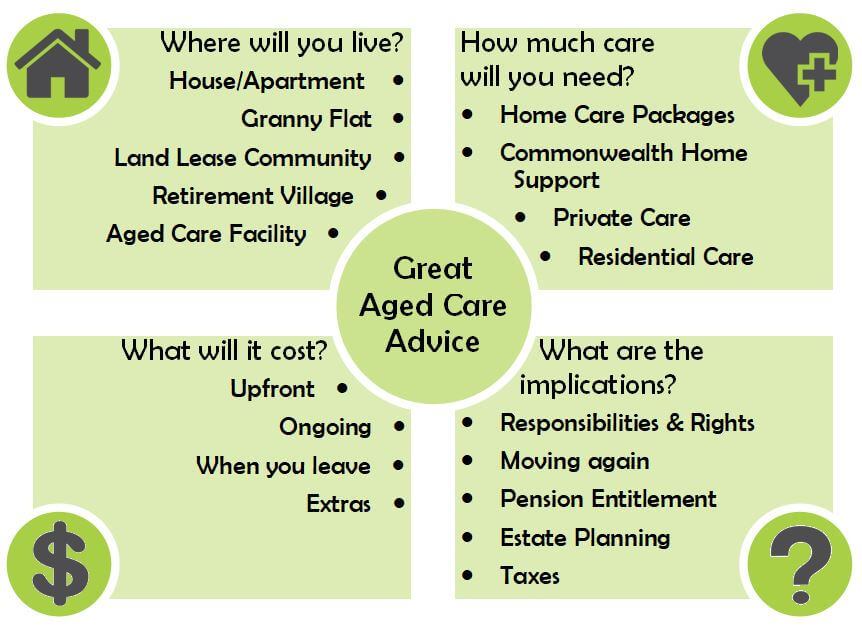

It is very important to ask the right questions when considering your aged care options to make sure the services offered are aligned with your lifestyle goals and budget.

Plan your move well ahead

Moving house can be stressful at any age, but particularly so when you are elderly and frail and have a lifetime of memories stored in your family home. Everyone wants the best possible living conditions for themselves and their loved ones, so it’s important not to make decisions in a rush at the eleventh hour. The decision about whether it’s better to sell the family home or keep it and rent it out to help fund the ongoing cost of care has significant financial implications, and is one that needs careful consideration.

Plan to make it easier

This is where we can help. Strategies for wealth creation that take into account all your retirement needs, including the possibility that you will need some form of aged care, are increasingly relevant. With careful planning you need never compromise on the life you want to lead.

As the saying goes, you’re never too young to plan your future. But you’re never too old either!

Sources:

Australian Institute of Health and Welfare 2020 https://www.aihw.gov.au/reports/older-people/older-australia-at-a-glance/contents/demographics-of-older-australians/australia-s-changing-age-and-gender-profile

WARNINGS, DISCLOSURES & DISCLAIMERS

While every care has been taken in the preparation of this article, Soundbridge Pty Ltd (ABN 40 151 134 146) and AFTA Pty Ltd (ABN 18 624 984 550, AFSL 507423) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts.

The information and any advice provided in this document is general and has been prepared without taking into account your objectives, financial situation or needs, and might not be appropriate to your situation. Because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to those things. Past performance is not a reliable indicator of future performance. AFTA Pty Ltd does not warrant that future forecasts are guaranteed to occur.

The information in this document reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document.

Soundbridge Pty Ltd (ABN 40 151 134 146) is a representative of AFTA Pty Ltd (ABN 18 624 984 550), Australian Financial Services License (507423), Registered office at 166 Quay Street, Rockhampton QLD 4700.

Any advice on this website is of a general nature only and has not been tailored to your personal circumstances. Please seek personal advice prior to acting on this information.

Posted on August 13th, 2020