Advisers’ benefit goes beyond financial returns

Advisers have never been more valuable than they are right now, in the midst of these challenging times.

According to Russell Investments, in their annual report that holistically analyses the real value that Advisers deliver to their clients in their portfolios, financial advisers deliver 5.2% or more each year to their clients, but the firm has highlighted the value of advice goes beyond just financial returns.

It said an Adviser charging an advice fee of $3,250 to a client with a $250,000 balance could potentially deliver $13,250 of value.

However, there were numerous other ways that seeking advice benefited a client including preventing behavioural mistakes, and advising on asset allocation. Avoiding behavioural mistakes was the biggest benefit for clients, adding at least 2.2% per annum to a client’s portfolio by stopping them from chasing past performance or making short-term moves.

This was particularly evident during the pandemic and market downturn as the firm found someone with an investment balance of $250,000 who moved to cash on 16 March would have locked in losses of more than $50,000 versus a member with the same balance who stayed invested during the volatility, recovering almost $20,000 already by the end of May.

Tax effective investing was the next biggest contributor, representing 1.5% of added value.

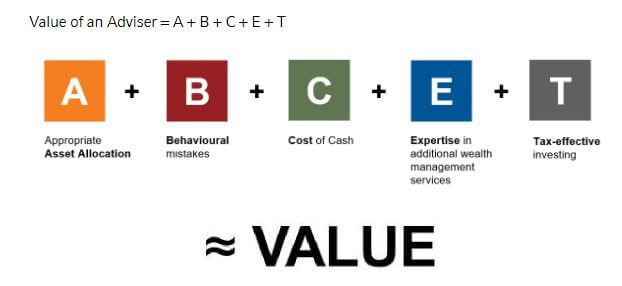

In its ‘Value of Advice’ report, the firm said the five benefits were:

A is appropriate asset allocation. Helping clients to work through their values, preferences and motivations from the outset.

B is for behavioural mistakes. Helping clients avoid common behavioural tendencies may help achieve better portfolio returns than those investors making decisions without professional guidance.

C is for cost of cash. Holding too much cash can come at a cost. Advisers can assist clients in investing in a well-diversified portfolio that seeks to balance the needs of liquidity and targeting growth within the risk levels appropriate to the client.

E is for expertise. A common misconception is that financial advisers are purely investment managers, whose only job is to select investments and achieve a certain level of return – quality financial advice goes way beyond this.

T is for tax-effective investing. Advisers play an important role in a client’s tax journey, helping them navigate key components when it comes to tax-efficient strategies.

Russell Investments head of business solutions, Bronwyn Yates, said: “Our report shows advisers can play a critical role in helping investors avoid common behavioural tendencies and may potentially help their clients achieve better portfolio returns than those investors making decisions without professional guidance.”

Let us demonstrate the value of advice – catch up with your Adviser today, to review your financial situation, or if you are not a Soundbridge client, get in touch for a no cost, no obligation, discovery meeting.

WARNINGS, DISCLOSURES & DISCLAIMERS

While every care has been taken in the preparation of this article, Soundbridge Pty Ltd (ABN 40 151 134 146) and AFTA Pty Ltd (ABN 18 624 984 550, AFSL 507423) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts.

The information and any advice provided in this document is general and has been prepared without taking into account your objectives, financial situation or needs, and might not be appropriate to your situation. Because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to those things. Past performance is not a reliable indicator of future performance. AFTA Pty Ltd does not warrant that future forecasts are guaranteed to occur.

The information in this document reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document.

Soundbridge Pty Ltd (ABN 40 151 134 146) is a representative of AFTA Pty Ltd (ABN 18 624 984 550), Australian Financial Services License (507423), Registered office at 166 Quay Street, Rockhampton QLD 4700.

Any advice on this website is of a general nature only and has not been tailored to your personal circumstances. Please seek personal advice prior to acting on this information.

Sources:

https://russellinvestments.com/au/blog/5-key-ways-advisers-deliver

Posted on November 6th, 2020