2021 Federal Budget Highlights

Greater flexibility for older Australians to boost superannuation, continued support for small business, and extra help for struggling homebuyers are key drivers in the Federal Government’s 2021 Budget, designed to steer Australia away from a pandemic recession.

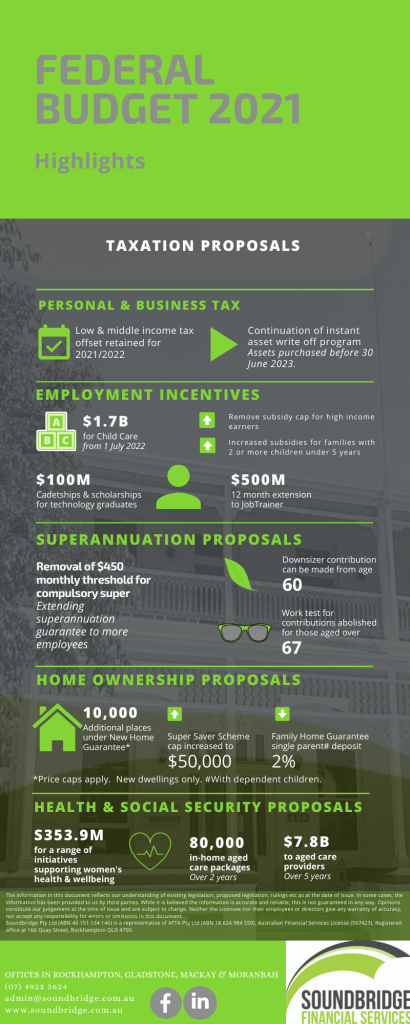

Retirement savings proposals

Australians aged 67 to 74 will no longer need to satisfy the ‘work test’ requirements in order to make super contributions, while the age requirement on “downsizer” contributions, which allows top-ups of up to $300,000 per person, will drop from 65 to 60.

While these changes will not come into effect until 1 July 2022, they will allow many older Australians to make significant super contributions and effectively restructure their financial affairs, even after they have retired and left the workforce.

Approximately 300,000 working Australians, mostly women, earning $450 or less a month from a single employer will now receive full super guarantee contribution entitlements, providing a significant boost to their retirement savings.

Business Support Programs Extended

The Government will further accelerate economic growth by extending three of its most successful small business support programs.

Temporary full expensing will continue until 30 June 2023. Small business owners can claim the full cost of buying a car or piece of equipment as an immediate tax deduction.

Temporary loss carry-back provisions will now include the 2023 financial year. Businesses can claim a tax refund with ‘carry-back’ losses from one trading period used to offset a profit from a previous trading period.

The Job Trainer program will also continue with the Government providing a 50 per cent wage subsidiary for another 270,000 new apprentices and trainees hired by Australian businesses, as well as a raft of other employment boosting initiatives.

Help for Potential Homeowners

Those struggling to take their first step on the property ladder will benefit from the Federal Government’s decision to allow first home buyers to access $50,000, up from $30,000, from their superannuation savings to contribute to their deposit.

Some 10,000 Australians will be able to buy a new home with just a five per cent deposit under the New Home Guarantee, while a further 10,000 single parent families will be able to buy a home with just a two per cent deposit under the Family Home Guarantee.

Social Initiatives

Other initiatives include:

- $353.9 million for a range of initiatives supporting women’s health.

- An extra 80,000 in-home aged care packages over the next two years.

- $7.8 billion to aged care providers over the next five years.

- $1.7 billion for childcare effective from 1 July 2022. This will include the removal of the subsidy cap for high-income earners and increased subsidies for families with two or more children under five years.

- The extension of the temporary low- and middle-income earners tax offset, where those earning less than $126,000 will receive a $1,080 tax offset until 2022.

Many of these announcements will not come into effect for some time, so to find out how and when you can benefit, be sure to seek specialist advice from your accountant or financial adviser.

While every care has been taken in the preparation of this article, Soundbridge Pty Ltd (ABN 40 151 134 146) and AFTA Pty Ltd (ABN 18 624 984 550, AFSL 507423) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts.

The information and any advice provided in this document is general and has been prepared without taking into account your objectives, financial situation or needs, and might not be appropriate to your situation. Because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to those things. Past performance is not a reliable indicator of future performance. AFTA Pty Ltd does not warrant that future forecasts are guaranteed to occur.

The information in this document reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document.

Soundbridge Pty Ltd (ABN 40 151 134 146) is a representative of AFTA Pty Ltd (ABN 18 624 984 550), Australian Financial Services License (507423), Registered office at 166 Quay Street, Rockhampton QLD 4700.

Any advice on this website is of a general nature only and has not been tailored to your personal circumstances. Please seek personal advice prior to acting on this information.

Posted on May 18th, 2021